The core function of a bookkeeper is to ensure that all bills are paid on time, transactions are recorded correctly, payroll runs on time and taxes are filed correctly. However, the role can vary greatly from business to business. So if you’re looking to hire a bookkeeper, it is essential to create a bookkeeper job description that fills your recruitment funnel with ideal candidates as quickly as possible.

What Does a Bookkeeper Do?

A bookkeeper is responsible for recording daily financial transactions, updating a general ledger and preparing trial balances for perusal by accountants. They maintain and file requisite documents for taxation compliance. They monitor cash flow and produce financial reports to assist managers in taking strategic decisions. Bookkeepers may also assist in running payroll and generating invoices for your company.

Difference Between Bookkeeper and Accountant

A typical accounting cycle has eight steps: New transactions, journal entries, posting, trial balances, worksheets, journal entry adjustments, financial statements, and closing the books. The key difference between a bookkeeper and an accountant is that a bookkeeper is generally responsible for the first six steps. An accountant is responsible for the last two, which involve preparing the balance sheet, income statement, cash flow statements, and closing the books.

Bookkeeper Responsibilities

Responsibilities for bookkeepers can vary widely from business to business, though there are a number of very common bookkeeping responsibilities. Remember that you want to tailor the role’s responsibilities in the job description so that it’s not just aligned with the position but with your company.

Here are the most common responsibilities of a bookkeeper:

- Establishing different accounts

- Maintaining records of financial transactions by posting and verifying

- Defining bookkeeping policies and procedures

- Developing systems to account for financial transactions by establishing a chart of accounts

- Maintaining subsidiary accounts by posting, verifying and allocating transactions

- Reconciling entries to balance subsidiary accounts

- Maintaining a balanced general ledger

- Preparing a trial balance for the accountants

- Preparing financial reports by collecting, analyzing and summarizing accounting for information

- Ensuring compliance with federal, state and local legal requirements

- Monitoring for variances from the projected budget

- Advising management on compliance needs

- Assisting in financial activities such as running payroll and generating invoices

Additionally, there may be other responsibilities based on the unique needs of your business. For example, a bookkeeper may be required to learn a specific accounting software system or participate in certain meetings.

Bookkeeper Qualifications

Qualifications can vary based on your organization’s needs. However, you want to at least include education, experience and licensing requirements in your job description.

- Bachelor’s degree in accounting, finance or related discipline

- CPA is desirable

- Previous bookkeeping experience preferred

- Experience working in a fast-paced environment

When possible, be as specific as possible. For example, note which software you want a candidate to be familiar with–including general programs that your office uses.

Bookkeeper Skills

Here is a list of desired bookkeeper skills. Again, include what is relevant to your company.

- Basic accounting knowledge

- Understanding of industry benchmarks in accounting best practices

- Knowledge of IFRS, U.S. GAAP or other industry-standard accounting frameworks

- Expertise in Microsoft Excel or any other spreadsheet

- Establishing accounts

- Developing standards

- Data entry

- Deep understanding of accounting principles

- Confidentiality

- Attention to detail

- Comfortable dealing with huge volumes of complex data

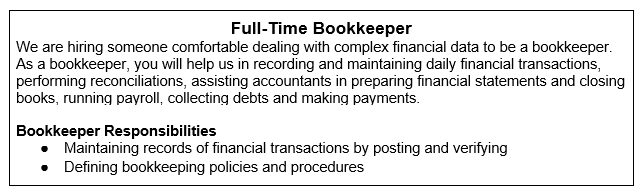

Bookkeeper Job Description Example

Below is a sample bookkeeper job description that you can customize to meet the needs of your business.